[

{

"name": "Air - Inline Content - Upper",

"component": "26908817",

"insertPoint": "1/4",

"requiredCountToDisplay": "8"

},{

"name": "Air - Inline Content - Middle",

"component": "26908818",

"insertPoint": "1/2",

"requiredCountToDisplay": "8"

},{

"name": "Air - Inline Content - Lower",

"component": "26908819",

"insertPoint": "100",

"requiredCountToDisplay": "1"

}

]

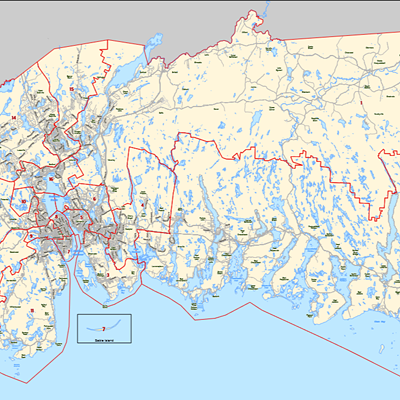

| Case study: Neighbouring suburban communities | Kingswood | Upper Hammonds Plains |

|---|

| Market value of average house | $542,020 | $107,380 |

| Current city and provincial tax | $5,908 | $876 |

| City and provincial tax under “reform” | $3,311 | $1,532 |

| City’s share of current taxes | $3,813 | $560 |

| City taxes under “tax reform” | $1,216 | $1,216 |

| Change in city tax | $2,597 lower (-68%) | increases $656 (+117%) |

| | | |

| Note: The “average house” is an amalgamation of 10 houses. Methodology here. | | |

| | | |

| | | |

| Case study: An extremely regressive tax system by design | David & Margaret Fountain, Young Avenue | Bill & Helen Zebedee, Clement Street |

|---|

| Market value of house: | $4,040,300 | $149,700 |

| Capped assessment: | $3,379,900 | $145,500 |

| Present tax system | | |

| City tax bill: | $28,695 | $1,235 |

| Tax per $100 of capped assessment: | 84.9 cents | 84.9 cents |

| Tax per $100 of market value: | 71 cents | 82.5 cents |

| Under “reform” proposal | | |

| Services charged: | all urban | all urban |

| Tax bill: | $1,316 | $1,316 |

| Tax per $100 of market value: | 0.03 cents | 87.9 cents |

| |

| Note: Tax figures reflect only the city’s portion of property tax bills, and do not include the provincial and supplemental educations charges, which remain the same under both scenarios. | | |

| Case study: How “reform” taxes apartments | |

|---|

| Halifax Peninsula** | Dartmouth** |

| | |

| Quinpool Tower | Marine View Terrace |

| - $96 / unit | + $221 / unit |

| | |

| Fenwick Tower | Westgate Apartments |

| + $55 / unit | + $140 / unit |

| | |

| SouthPoint Apartments | 96 Highfield Park Drive |

| - $10 /unit | + $198 / unit |

| | |

| Ogilvie Apartments | 4 Franklyn Court |

| + $26 / unit | + $258 / unit |

| | |

| | |

| **Based on 2007 figures. |