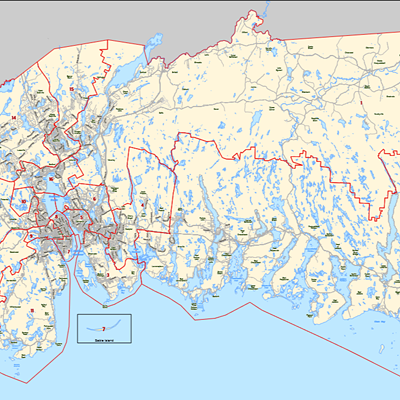

There is necessarily some problem with figuring out the exact effects of “tax reform.”

That’s because, on the one hand, the Tax Reform Committee’s work dealt exclusively with 2007 budget numbers and the committee has not increased the numbers in their proposal to reflect an increase in city costs since then.

On the other hand, the assessments of houses and condos have been raised in the two years since, and I have assessment cap information for 2009, not 2007.

So I was left comparing 2007 “tax reform” numbers to 2009 tax information. Using those numbers brings *slightly* skewed results---if council adopts the “tax reform” proposal, those numbers will be somewhat increased, so those properties I reported as receiving tax increases will receive slightly higher tax increases than I reported, while those I reported as receiving decreases would receive slightly lower decreases than I reported.

For example, the assessment cap on my Central Dartmouth house was pegged at $178,800 in 2007 and $189,100 in 2009. Using the 2007 “tax reform” fees and 2007 capped assessment, my tax bill would have been lowered by $201. Using the 2007 “tax reform” fees and the 2009 capped assessment, my tax bill would be lowered by $186—a difference of $15, for a house with a market value assessment of $215,800.

I attempted to resolve this problem by asking city staff for an inflation multiplier for the 2007 fee figures. I assumed that either the rate of general inflation (CPI) or the rate of inflation for the cost of municipal services, or simply the actual increase in the city budget would suffice, but staff rejected each for a variety of technical reasons.

Lacking that information, I decided it really didn’t much matter, for two reasons.

First, assessments have been capped at the rate of inflation for the past two years---just 2.3 percent in 2008, 3.4 percent in 2009 and 0 percent for 2010, a cumulative rise of less than six percent. In a perfect world, the cost of municipal services would have risen by six percent as well, but staff rejects that approach, leaving me at loose ends. At best, if we want to be as accurate as possible, we should probably add in a six percent “fudge” factor.

But, secondly, why bother? The package the Tax Reform Committee has put before council consists of the 2007 numbers. If the Committee doesn’t want to update them, and staff doesn’t want to suggest an inflator, that’s not my problem. The 2007 numbers are before us, and I’ve used them.

Whatever inaccuracies these problems introduce to the numbers, they don’t change the overall pattern of a shift in the tax burden from higher valued properties to lower valued properties. They will, additionally, shift the value of the point between paying more in taxes to paying less in taxes upward. In 2007, for houses on the peninsula and most of Dartmouth, that point was about $163,000---houses assessed at less than that would pay more in taxes, while houses assessed at more than that would pay less in taxes. In 2009, I suspect, but don’t know for certain, that the point is about $175,000. So, if anything, the overall thrust of my article is understated---more people would pay more.

I’ll note though, that for apartments, I used the 2007 assessment numbers (the assessment cap doesn’t apply to apartments so the problem noted above doesn’t enter the equation). So the figures for apartments are the exact effect the “tax reform” proposal would have had in 2007.