I t's a familiar story. A rich country develops oil fields in a heavily indebted nation with lax environmental rules. Local residents object, saying oil and gas extraction degrades their air, water, quality of life. Protests mount as the foreign energy company steamrolls the permitting process. The rich country tries to influence local elections in the foreign country. Complaints about spills and leaks pour in. Lawsuits fly. There are rumblings that civil disobedience may erupt if the foreign developers keep marching through the countryside.

This has been repeated in Nigeria, Ecuador, Indonesia and elsewhere. Economists call it the "resource curse"—countries with minerals or oil are exploited by foreign powers and end up with damaged land, poisoned waters and sullied air. In a new twist to an old tale, however, the "foreign developer" in this case is Canada, and the "neighbour" is the United States. Specifically, Boulder County, Colorado.

The big deal

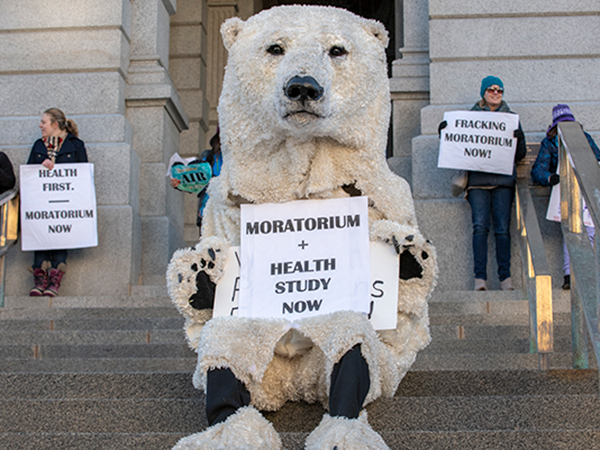

In October 2015, the Canada Pension Plan Investment Board announced a $900-million deal to purchase oil and gas assets from Encana, at that point one of the largest producers in Colorado. But the planned purchase stalled as financial and social pressures bore down on the oil and gas industry.Some Encana holdings were in counties that had banned hydraulic fracturing, or fracking. The oil and gas industry challenged those bans, and the legal fight reached the Colorado Supreme Court as the Encana deal was being negotiated. In early 2016, the fracking bans were still in place, oil bottomed out at $34 a barrel and Encana's stock had dropped to below $5 from $24 in the summer of 2014. Citizens' groups were organizing ballot measures in Colorado to force new oil and gas development further away from where people lived, and suburban parents who had never done anything more political than attend PTA meetings became "fracktivists," planning civil disobedience actions in local libraries.

Then came the Colorado Supreme Court's landmark May 2016 decision, invalidating "local control" bans in favour of statewide authority to foster oil and gas development. Historically that's meant the state approves any completed drilling permit application.

Citizens across the fast-growing region north of Denver where the Rocky Mountains meet the Great Plains, known as the Front Range, were outraged after working to get local fracking bans approved by voters. But the ruling was good news for the Canadians.

Soon after, on August 11, 2016, the Canada Pension Plan Investment Board announced the purchase from Encana and creation of a new company, Crestone Peak Resources. When the negotiating dust settled, Encana's wells and a chunk of sub-surface Colorado real estate—in the oil and gas-rich Denver-Julesburg Basin—went for about 30 percent less than had been announced just months earlier.

"Most Canadians would be surprised to know they own a fracking oil company in Colorado." —John Bennett, senior policy advisor at Friends of the Earth Canada.

tweet this

According to documents filed with the Colorado Oil and Gas Conservation Commission, Crestone became one of the largest companies in Colorado focusing on drilling in residential areas of the state's most populous region. The pension plan investment board reported paying $609 million for the Encana deal. An affiliate of the Broe Group, a Denver-based company, acquired three percent of Crestone.

You might not have heard of the CPPIB, but you may be funding it. It's the quasi-governmental organization responsible for investing the Canada Pension Plan contributions coming off the paycheques of some 20 million Canadians. As the federal government puts it, "You contribute to the CPP if you are over the age of 18, work in Canada (outside of Quebec) and earn more than $3,500 a year."

With $368 billion in assets, the CPPIB is a behemoth with a vast portfolio that includes renewable energy projects, real estate and business ventures around the globe. But as institutional investors become increasingly aware that new oil and gas development is burdened with moral, legal, financial and ecological problems, CPPIB's Colorado investment raises a pressing question: With all the investments in the world available to them, why would widows in Winnipeg, retirees in Richibucto and teachers in Tantallon want to invest in Colorado's escalating fracking wars?

Toxic assets

In the Encana deal, the CPPIB bought what one oil and gas engineer says are known as "toxic assets" by industry insiders: Oil and gas leases scattered among housing developments in the rapidly growing state. Did the CPPIB realize this was a controversial purchase?The CPPIB did not respond to multiple phone messages, email requests for an interview or a list of emailed questions sent over the course of more than a month, despite having an extensive public relations department. Just before deadline, a short email arrived from Darryl Konynenbelt, CPPIB's director of global media relations: "CPPIB declines to comment. We refer all questions to Crestone." (See sidebar "Know comment.")

In an interview, Encana spokesperson Doug Hock said the fact that many of the company's Colorado assets were located in areas where there was growing resistance to oil and gas development "was a factor" in the decision to sell. He emphasized, however, that it wasn't the main one. "Our D-J Basin assets certainly had challenges compared to our other assets," Hock said. "They were good wells, but they didn't fit into our growth strategy." About the timing of the sale and the last-minute price drop from $900 million to $609 million, Hock emailed: "I've been told that there are non-disclosure agreements that preclude the parties from discussing those details."

Crestone Peak, in an email from its public relations department, said there was nothing unusual about the price drop. "It's very common in acquisitions for the valuation of a company to change from once the acquisition is announced to final closing," they wrote. Crestone declined to discuss specifics of its business because it is a private company.

Whatever the reasons for the reduced price and Encana's motivation to sell, the CPPIB must have known there would be substantial pushback. Several of the CPPIB's directors, as well as several of Crestone's board members and executives, had worked for Encana. This includes Avik Dey, a CPPIB managing director and head of energy and resources, who has worked for all three and is currently chair of the board at Crestone Peak Resources. In a CPPIB press release on Oct. 8, 2015 announcing the deal, Dey said, “This investment offers attractive economics and aligns well with our strategy for the energy sector.”

In Canada as in Colorado, fracking is highly controversial, with Nova Scotia, New Brunswick and Quebec effectively banning the practice. "I don't think they would ever have invested in a fracking company in Canada," says John Bennett, a senior policy advisor to the environmental group Friends of the Earth Canada. "It's a very odd thing for this pension fund to be doing," he says. "Most Canadians would be surprised to know they own a fracking oil company in Colorado."

Ken Summers isn't surprised, but he's on the steering committee of NOFRAC—the Nova Scotia Fracking Resource and Action Coalition—and researches the business side of oil and gas for the anti-fracking group. "I'm an educated investor, so I know what they do," he says of the CPPIB. "I know I don't have any control over it." Now retired and living in Minasville, Summers sees the investment board as "a big sleeper," deliberately trying to stay under the radar and avoid scrutiny. In corporations, he says, "as long as you keep producing profits for shareholders, you'll never have problems. The CPPIB is kind of like that. They don't get noticed because they consistently make money."

Most Coloradans probably haven't noticed that workers and pensioners across Canada are invested in drilling operations in the Centennial State's suburban backyards. Coloradans who do know about the Canadian connection are baffled.

"I have to wonder if the beneficiaries of the pension fund's investments understand what they're investing in," says Boulder County commissioner Elise Jones. She says as far as she knows, virtually every elected official in the county, as well as the overwhelming majority of residents, oppose the kind of residential drilling Crestone has proposed—and wish they could halt it.

“This investment offers attractive economics and aligns well with our strategy for the energy sector.”—Avik Dey, managing director of CPPIB and chair of the board at Crestone Peak Resources

tweet this

Pressure has been mounting for years around Colorado to put some brakes on the industry. Repeated fires at oil and gas sites, and an explosion from an abandoned pipeline that killed two people in 2017, only added to the tensions. In Colorado's 2018 elections, oil and gas issues figured prominently, from the governor's race to several ballot initiatives.

Along with its investment in the fracking business, Crestone Peak also invested in those elections. Crestone gave $607,500 to support groups that directly or indirectly opposed Proposition 112, a setback initiative that would have required new oil and gas development to be placed more than 750 metres from homes and schools. The proposition was defeated.

Crestone has applied for a Comprehensive Drilling Plan to move into Boulder County, but the applications for drilling permits are still awaiting approval from the Colorado Oil and Gas Conservation Commission, which is slated to meet about Crestone's drilling plan in late April. If approved, the plans then have to survive a lawsuit filed by Boulder County.

Although Boulder County has not seen new drilling since its ban was lifted by the state Supreme Court, just across the county line the impacts of residential oil and gas development are plain to see. In adjacent Weld County, there are 21,694 active wells, according to the COGCC website. There, residents have been powerless to stop multi-well pads and mini-industrial complexes from being located near homes and school playgrounds.

Getting fracked in Erie

Perhaps no place illuminates these conflicts better than Erie, which straddles both Boulder and Weld counties north of Denver. A sleepy farming community with a population of about 2,000 people in 1990, Erie is a bedroom community of around 25,000 today.The first citizen complaint against Crestone's operations was filed on November 16, 2016, three months after the CPPIB/Encana deal was finalized. Noise from a drilling operation in the middle of Erie was so loud it was "like a huge semi truck parked in our driveway," according to the anonymous complaint.

Other complaints poured in to the COGCC, reporting rumbling and shaking of Erie homes, pictures falling off of walls, and disturbing vibrations night and day for weeks on end. Dank smells emanated from the drilling sites, which were near large tract homes, parks, schools, a skate park and even the city offices. Residents started a black humour joke that their town should be renamed "Eerie."

Monica Korber, who works from her Erie home as an efficiency consultant to businesses, recalls trying to sleep with her bed shaking through the night. Fearful and concerned, she asked other neighbours if they had experienced the same thing, and soon dozens of people were sharing stories on social media and asking what this new company Crestone was doing to rattle their lives so viscerally. "We never got a straight answer," Korber says.

After the rumblings stopped with that phase of the project, Crestone pressed on. Soon, Erie residents were complaining at COGCC meetings and on the agency's website about noxious smells, leaks, nosebleeds, headaches, industrial noises and lights burning all night outside their bedroom windows. Korber learned that Crestone was applying for even more permits to drill, and drove to Denver last October to speak at a COGGC meeting. She told the commissioners, with her best grandmother-of-five scolding voice, "I bet that not one of you lives in Erie."

Not one of the nine commissioners does.

Erie's experience with Crestone isn't isolated. The number of complaints filed against Crestone is almost twice as many as the next five oil and gas companies conducting business in Colorado combined. There were more than 1,000 complaints filed against Crestone's operations between November 2016 and February 2019. The only other company that comes anywhere close, at 245 complaints, is Extraction Oil and Gas, another relatively new company with holdings in residential areas on the Front Range. Other major operators in the D-J Basin collectively only had 350 complaints over the same period. One likely reason: Most other top producers are operating on agricultural lands or in much less populated areas.

Jason Oates, Crestone's spokesperson, has repeatedly stated that residents have abused the complaint process in Erie by organizing complaining campaigns. In its email response to questions, Crestone's public relations department said that "while none of the complaints resulted in a violation of state standards by the COGCC...we knew we needed to make some changes in our operations. We took an above-and-beyond approach to further lessen the temporary impacts that we may have on neighbouring communities."

One such flurry of impacts and complaints came in September 2017, after Crestone's operations caused a release of toxic gases at a site in Erie less than 25 metres from the Aspen Ridge Preparatory School playground. Crestone was plugging and abandoning a set of wells, and had been venting air from them until a resident smelled noxious fumes and complained to the COGCC. The agency documented a large release of volatile organic compounds that have been linked to health problems including increased rates of asthma, childhood leukemia and low-birth weight babies. Those toxic emissions wafted onto the playground of the Kiddie Academy Childcare Center, confirms the COGCC's incident report.Large investors like the CPPIB “increasingly have a fiduciary duty to explain why they don't divest, rather than the other way around."—Clara Vondrich, global director of DivestInvest

tweet this

The COGCC ordered Crestone to cease operations until the problem was fixed, but parents didn't hear about the leak for months. Mark Kadlececk, who has children who attended Aspen Ridge, found the Notice of Alleged Violation posted on the COGCC website on October 25, six weeks after the violation.

Kadlecek wrote to the COGCC and local elected officials, sputtering outrage: "All three of my young children, between the ages of six and eight years old attend Aspen Ridge. This is a place that I thought they would be safe." Kadlecek tried to make the point that so many in Colorado communities have reiterated: What is legal in Colorado is simply not right. "Common sense mandates that oil and gas operations do not belong in close proximity to homes and schools," he wrote.

After the public outcry, Crestone issued a statement that was so bland it further inflamed residents: "We sincerely apologize for this oversight." In its emailed statement, Crestone added, "Activity at the location wrapped up with no further incidents."

The COGCC fined Crestone $10,000, according to Mike Leonard, the agency's community relations manager.

Christiaan Van Woudenberg, one of Erie's newly elected trustees, says that the Aspen Ridge incident and Crestone's other operations have led to one frustration after another. Different complaints—about noise or traffic or vibrations or smells or lights or emissions—need to be reported to different agencies, which frequently don't report to each other.

The bigger picture, he says, is that when companies like Crestone come into a small community such as Erie, dangling potential tax revenue and arguing (as Crestone spokesperson Oates told a community meeting) that there are "no health impacts" from fracking, it is almost impossible not to be steamrolled.

"Erie is fracked," Van Woudenberg says. "We lost. We're the cautionary tale."

A fraught investment

Besides the fact that Crestone is seeking to operate in communities that oppose it, there's a larger question for the CPPIB: Is residential drilling in Colorado a smart investment?

Crestone continues to face protests, legal challenges and lawsuits that are increasing the cost of doing business in Colorado. And it, in turn, has sued the state and at least one other oil and gas company, alleging interference in its operations.

From what is known about Crestone's financial picture, it hasn't performed well to date. While Crestone is private, there are several clues that the CPPIB's Colorado investment may be problematic. As of February 15, the CPPIB's website stated that the value of the investment had dropped to $543 million from the purchase price of $609 million.

Another possible clue about Crestone's financial situation comes from comparing the performance of Extraction Oil and Gas, a company that went public at almost the same time the Encana/CPPIB/Crestone deal was finalized, and that like Crestone started by purchasing larger companies' "toxic assets" in populated communities along the Front Range. Extraction was trading for $23 a share around the time of its October 2016 IPO. In early March, it was worth $3.60 a share.

"It is how, not if, we are going to drill.” —Jason Oates, spokesperson for Crestone Peak Resources

tweet this

Analysts are mixed about the future of shale gas extraction, which is usually accomplished by horizontal drilling and/or fracking. Some predict slow growth in 2019, or are convinced that many parts of the industry are burdened with debt and uncertainty about future regulatory regimes, international price fluctuations and the increasingly competitive cost of renewable energy technology. Other investors remain bullish on oil stocks but are moving away from riskier investments in politically volatile countries such as Venezuela, Russia and Saudi Arabia—and are looking to US fracking operations as a safer alternative. Both Noble Energy and Anadarko reported record Colorado oil production in 2018.

From a longer-term perspective, a growing number of analysts say investments in fossil fuel companies don't make sense at a time when some fracking operations are losing money, liability from abandoned wells is getting more attention, and evidence mounts that oil and gas operations have increasing environmental and health impacts.

Then there's climate change, looming like a drilling rig's late-afternoon shadow over the fossil fuel investment debate. Canada, a signatory to the Paris climate agreement, faces some cognitive dissonance with the CPPIB's fossil fuel portfolio. Financial and legal analysts, as well as climate activists, point out that the country cannot export its fossil fuel investments and still claim it is moving to reduce its carbon footprint.

Canada is heavily invested in the oil and gas sector, and all recent indicators are that those investments "already have a lot of risk," says Cynthia Williams, a law professor at Osgoode Hall in Toronto and co-author of a report entitled "It is Time." "Why would the CPP be doubling down on oil and gas developments?"

Various organizations in Canada have tried to push the CPPIB towards a more sustainable, lower-carbon portfolio, without much success, says Bennet of Friends of the Earth Canada. The CPPIB has expressly avoided committing itself to "environmental, social and governance investments," stating that "Consistent with the CPP Investment Board's belief that constraints decrease returns and/or increase risk over time, we do not screen stocks or eliminate investments based on ESG factors. The CPP Investment Board considers the securities of any issuer all of whose businesses are lawful, and would be lawful if carried on in Canada, as eligible for investment."

As many effected residents have noted, what is lawful in Colorado isn't necessarily admirable. Many state laws were written in an earlier era of oil and gas exploration. They never anticipated the new horizontal drilling and fracking techniques that allow companies like Crestone to build pads of 10, 20 and 30 wells, and drill underneath hundreds of people's homes for kilometres in every direction. These well pads are accompanied by rows of storage tanks, condensers, combustors, separators and thousands of truck trips a day in and out of these mini-industrial complexes located near housing developments, schools, playgrounds, watercourses and otherwise baby stroller-packed suburban neighbourhoods.

Drilling and divesting

Groups looking to aggressively address climate change are targeting pension funds around the world. As concerns about climate change resonate across the globe, investments in fossil fuel companies are increasingly seen as bad bets. Viable alternatives are emerging—with better financial rewards.In the US, the divestment movement has made great strides in the past few years, ever since Stanford University made headlines by selling off its coal stocks in 2014. Clara Vondrich, the global director of DivestInvest, a philanthropy movement that encourages investors to move from fossil fuels to more sustainable investments, says since 2014, more than 1,000 institutional investors have committed to fossil-free investments, with growth of capital investments rising from $52 billion to more than $8 trillion today.

Vondrich says the DivestInvest movement has three core pillars: Moral, financial and legal. "The moral argument doesn't sway large institutional investors," she acknowledges. "But the financials do."

Various backdated investment comparisons, such as those done by the US divestment advocacy group As You Sow, show that portfolios without fossil fuel investments would have performed better than with them. "You're losing money for your beneficiaries" by investing in fossil fuels, DivestInvest's Vondrich says. "These are underperforming assets that are also burning up the planet." Now, she says, the large investors "increasingly have a fiduciary duty to explain why they don't divest, rather than the other way around."

At a January conference hosted by the Rocky Mountain Mineral Law Foundation, Crestone spokesperson Jason Oates told the audience that the company had met all of the requirements laid out by the COGCC for its drilling plans, and Crestone would forge ahead into Boulder County despite resident and local governments' objections. "It is how, not if, we are going to drill," Oates told the audience.

Back in Erie, grandmother Monica Korber says that she and her neighbours suffer not just the proximity of the industrial operations, but also from the discord that they have unleashed on her community. She has joined a lawsuit against her elected officials for not doing more to protect Erie citizens.

Korber's message to the CPPIB? "Why don't you drill next to the homes of the people where you're sending those retirement cheques?"

Journalist Daniel Glick has been covering climate change issues for more than 20 years, and written for Newsweek, National Geographic, The New York Times Magazine, Esquire, Outside and more than a dozen other periodicals. The author of two non-fiction books, Dan is a recipient of the Ted Scripps Fellowship in Environmental Journalism at the University of Colorado.

Photojournalist Ted Wood’s work has appeared in publications including Vanity Fair, Smithsonian, Newsweek, Time, Audubon, The New York Times, High Country Newsand The Nature Conservancy Magazine. A member of the International League of Conservation Photographers, Ted is also a recipient of the Ted Scripps Fellowship in Environmental Journalism at the University of Colorado.

The Story Group is independent, multimedia journalism company in Boulder, Colorado, with a focus on environmental coverage.

This story also appears, in slightly different form, in Boulder Weekly.